Save $25 to $500 w/code! - details

Financing with Affirm

Quick and Easy Financing

Your Affirm account is created using your name, email, mobile phone number, birthday and last 4 digits of SSN. This combination helps Affirm verify and protect your identity.

Make Easy Monthly Payments over 3, 6, 12, 18 or 36 Months

Affirm loans are designed to be flexible to fit different budgets. For example on a $1000 purchase, you may pay $87.92 for 12 months with a 10% APR. A down payment may be required. Actual rates will be shown at checkout. Rates are between 10-36% APR.

No Hidden Fees

Know upfront exactly what you will owe, with no hidden costs and no surprises. No late fees, no prepayment fees, no annual fees, and no fees to open or close your account.

Safe and Secure

Affirm connects directly to online stores. There is no card number to steal, so your account stays secure.

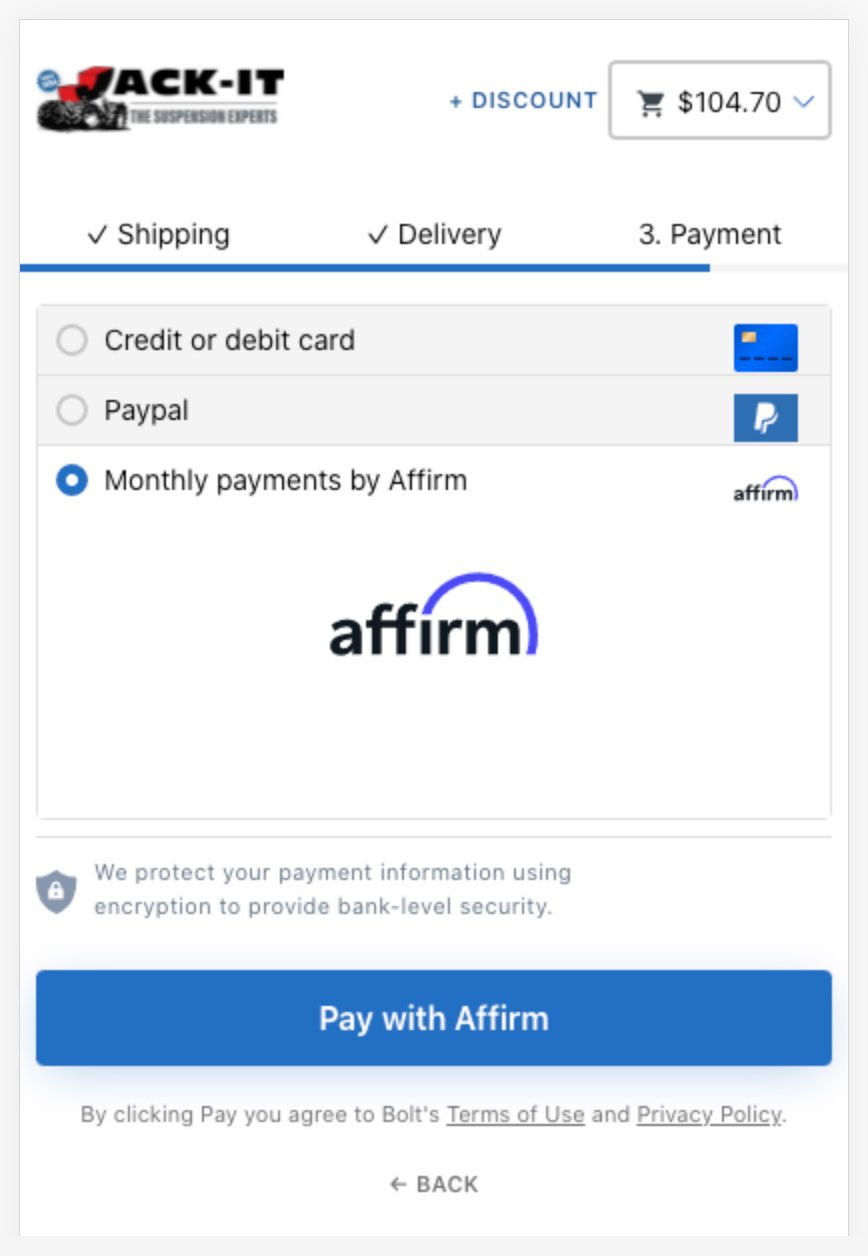

How it Works

- 1. Add items you wish to purchase to shopping cart

- 2. Complete checkout and select “Monthly payments by Affirm” for payment method

- 3. Make easy monthly payments to Affirm

Frequently Asked Questions

What information does Affirm require?

Your Affirm account is created using your name, email, mobile phone number, birthday and last 4 digits of SSN. This combination helps Affirm verify and protect your identity.

How do I pay may bills ?

You can pay your Affirm bills online at www.affirm.com/pay. They accept payment by debit card, bank transfer and check.

Does Affirm perform a credit check?

Yes, when you first create an Affirm account, Affirm performs a “soft” credit check to help verify your identity and determine your eligibility for financing. This “soft” credit check will not affect your credit score.

Can I return products purchased with Affirm?

Yes, products purchased using Affirm as a payment method can be returned the same as any other payment method. All returns are subject to our return policy. Refunds are applied to your Affirm balance.